It’s no secret that Florida is lighter on tax payers than most other states. It’s why so many people have come here to retire. Defer your income into a retirement account, move to Florida, take it out with no state taxes. As Jerry Seinfeld once said “My parents didn’t want to move to Florida, but they turned sixty and that’s the law.” But Florida isn’t just for retirees. Working residents have some advantages as well.

The personal-finance website WalletHub today released its 2023 Tax Burden by State report, in order to determine which states tax their residents most aggressively. WalletHub compared the 50 states based on the three components of state tax burden – property taxes, individual income taxes, and sales and excise taxes – as a share of total personal income. Here’s how Florida ranks.

- 46th – Overall Tax Burden (6.33%)

- 25th – Property Tax Burden (2.75%)

- 44th – Individual Income Tax Burden (0.00%)

- 18th – Total Sales & Excise Tax Burden (3.58%)

So even though for homeowners here in Florida our property values have gone up, and insurance rates have gone up, but the taxes – not as much. We’re middle of the pack. That Homestead exemption helps out a lot. And let’s not forget that 0% individual income tax.

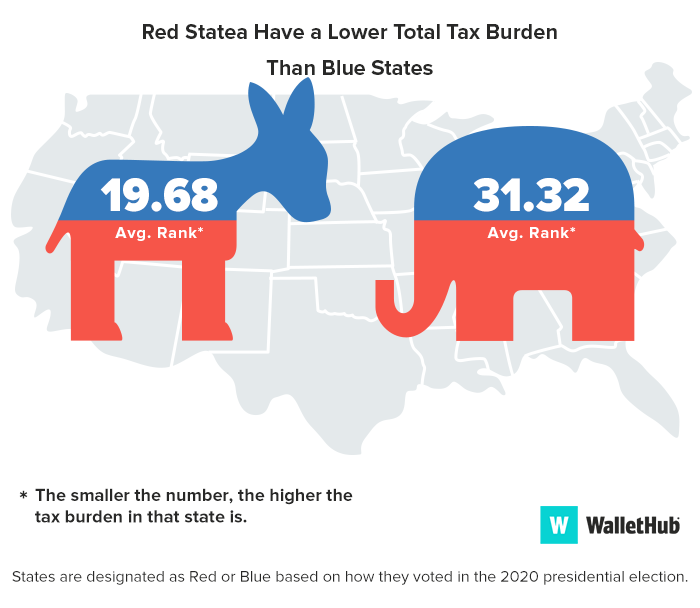

Do politics play a part in Florida tax vs. other states?

Oh, you bet they do. There’s a pretty clear graphic that shows that coming up.